Pocket Option Verification Time and Guide 2024

The new identity verification system works much faster judging by the positive comments from users. Presented below is the current method for verifying your account with this broker. However, the first step is to complete the initial registration and log in to your account.

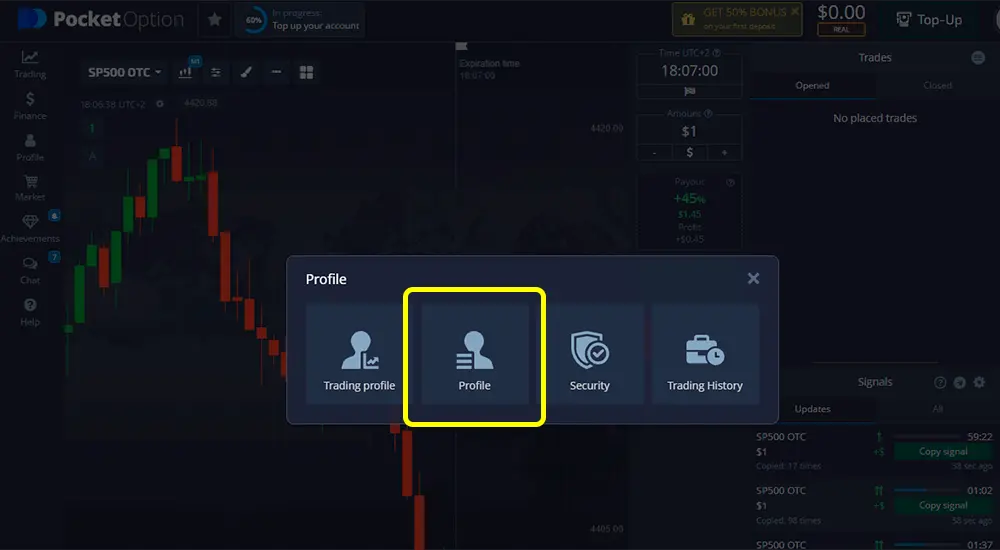

Next, pay attention to the vertical menu on the left or the user icon in the top corner (depending on the device you are using). Click on the «Profile» option in the menu, and in the pop-up window, select the «Profile» button.

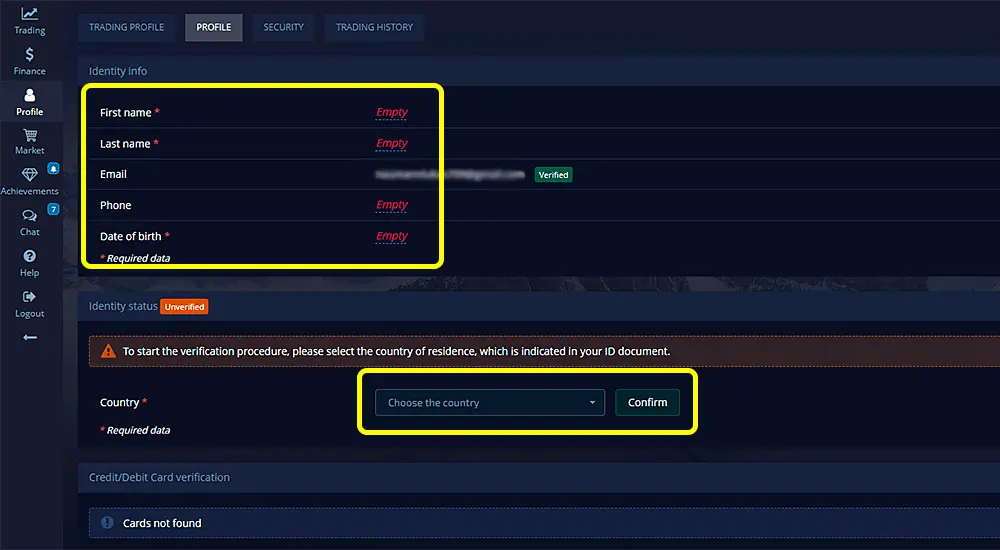

You will be redirected to a dedicated page with personal data settings. The first task is to add your name, surname, confirm the email you used during registration, and provide your personal phone number for enhanced security. Also, don’t forget to enter your date of birth. Please ensure that you use accurate information that matches your official documents.

Below, you will find a field to select your country of residence. Choose your country and click «Confirm.» Additionally, prepare the documents that verify your identity.

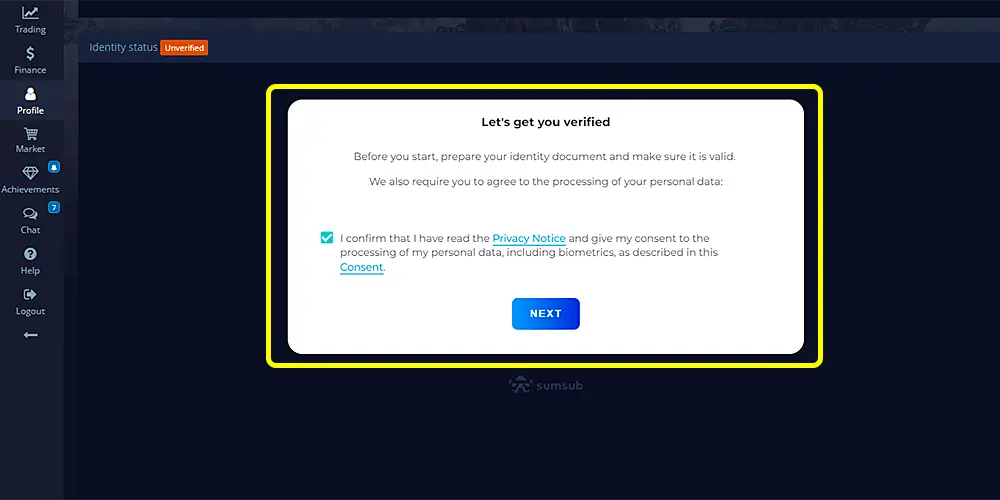

A dialogue box will appear, and a new intelligent verification system will ask you to agree to the terms and click «Continue.» If you were previously required to upload multiple document files, this new system is now being utilized for verification. Simply follow the instructions provided. The system will prompt you to take a selfie and provide the necessary documents.

For this procedure, access to your webcam is required. If your browser asks for permission to access the webcam, you must agree. Depending on your preference, you can complete the verification using either a smartphone or a PC/laptop with an available webcam.

While some individuals may find this new identity verification process inconvenient, it is a necessity in today’s modern landscape that demands innovative solutions. This procedure ensures the authenticity of individuals using their official documents, primarily for the safety of clients’ funds.

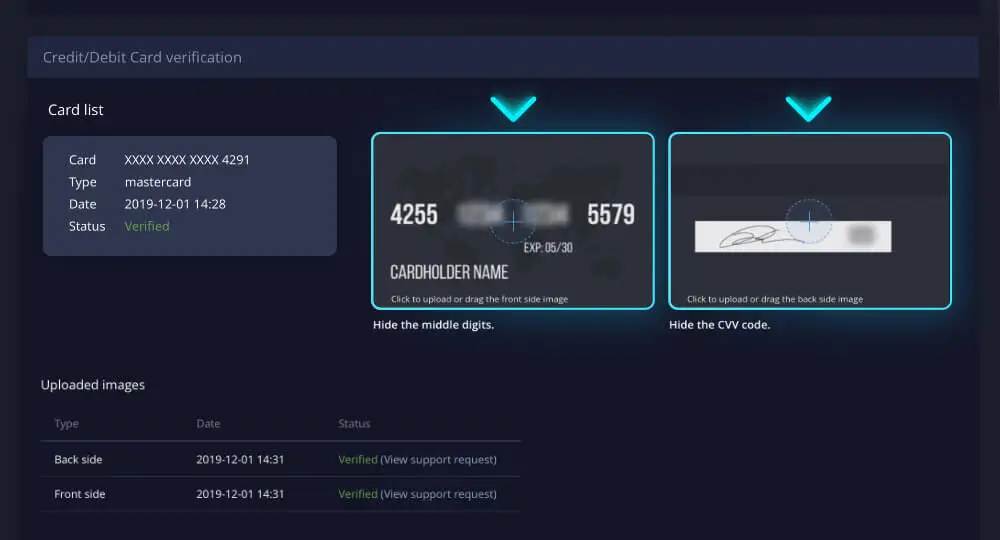

After the submitted documents are approved, you will have the option to add your bank card in the designated field. Pocket Option card verification – see screenshot below.

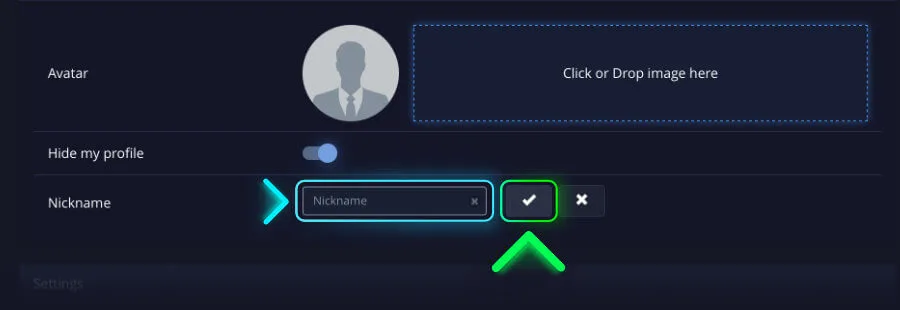

Upon successful Pocket Option verification, you can customize your nickname and choose an avatar if you wish. These details will be displayed in rankings and competitions among traders. Furthermore, if desired, you can hide your profile by clicking on the corresponding button.

Pocket Option Account Verification

Pocket Option is a reliable trading platform with great customer reviews, secure deposits and withdrawals. It also has a vibrant customer support team.

Its registration process is quick and easy, using Facebook, Google or email. Then, you just need to verify your account by uploading scanned images or photos of an identity document as well as a proof of address with information matching the one on your ID.

Identity Document

An identity document is a government-issued paper or plastic document that asserts a person’s civil identity in relation to the issuing state. It may contain a person’s name, date of birth, and other biographic information.

In most modern societies, people need some form of personal documentation in order to conduct various activities, such as applying for employment, housing, medical care, social benefits, and rations. These documents can be issued by a national government, state or regional governments, or local governments.

Many countries have established a system of national identity cards. These cards often include a photo of the card holder, their date of birth, and their home address.

Pocket Option requires its clients to undergo identity verification and address proof before they can begin trading. This process helps the company identify and monitor their users, and ensures that they comply with all KYC (Know Your Customer) policies and AML (Anti-Money Laundering) rules.

The identity verification process involves uploading scanned images or photos of an identification document like a driving license or passport. The submitted ID must have a clear image, be in the correct size, and match all details that were entered during registration on the site.

Once the identity document and address verification is completed, you can start trading on your account. You will also need to deposit funds to your account in order to make trades.

When you register for a free Pocket Option account, you can choose to use an email address or authorize via Facebook or Google accounts. After registering, you will need to upload a photo of your ID and proof of address as well as an initial deposit of $100 or more.

This is a fast and simple process that allows you to start trading right away. The platform offers 150 instruments for trading including foreign exchange currency pairs, shares and commodities of prominent companies.

To complete the identity verification process, you will need to upload a photo or scanned copy of your local ID card along with a utility bill. The utility bill does not have to be in your name, but it must contain a valid address.

Address Proof

Verification is a critical process for online businesses that engage in financial transactions or e-money services. It safeguards against scammers, hackers, and other criminals who may try to steal money from customers. It also allows sites to comply with regulatory laws and regulations.

A standard KYC check requires businesses to verify users’ identity and their home address before engaging in transactions. The most common proof of address is paper-issued documents, such as utility bills and bank statements.

Using geolocation data to verify addresses can be an effective and convenient way to speed up verification. However, regulators haven’t yet approved it as a standalone solution on par with physical document-based verification approaches.

In order to get your account verified on Pocket Option, you will need to upload both an ID document and a proof of address. This will unlock all the features of the platform, such as deposit and withdrawal options, bonus features, and more.

There are a few things to keep in mind when uploading an address proof: make sure the image is high-resolution, color, and uncropped (all edges are clearly visible). In addition, submit your address proof before it expires or gets lost, as this can delay the verification process.

The main reason why this is an important step in the verification process is that it helps prevent unauthorized access to your account and funds. If a scammer successfully tries to hack into your account and use your personal information, you can easily block their access through verification.

This process takes a couple of business days and can only be performed after you have uploaded all the required documents. In addition, the quality and size of your submitted files will affect the speed of the verification process.

Pocket Option values customer service and has multiple means of communication, such as live chat on their website or Instagram, Twitter, and Facebook accounts. This gives their clients plenty of ways to reach them, and their support is available 24/7.

Proof of Address

When you are opening a new bank account, it is important to have the right documentation in order to confirm your address. This can help speed up the process and ensure that your new account will be able to meet all necessary compliance requirements.

It is common for banks to require proof of residence, a document that can prove the actual address you live at. This can be a piece of government-issued ID, such as a passport or driver’s license, a utility bill from your provider, or other forms of proof.

Depending on your jurisdiction, there may be specific rules or guidelines for what documents are acceptable as proof of address. Checking with your local branch is the best way to find out which documents will be accepted and what stipulations the bank has on a particular type of document.

Some countries do not have rules that require proof of residence, such as Hong Kong. However, it’s still a good idea to consult with your local bank if you are planning to open an account in that country.

A variety of technologies are available for address verification that satisfy requirements, reduce costs, and deliver a better experience for your customers. For example, consent-based geolocation solutions like UtilityID use utility provider data to verify addresses, eliminating the need for manual downloads, uploads and scans.

In addition, these technologies can also speed up the process and ensure that accounts are opened in accordance with regulations and company policies. For instance, cryptocurrency exchanges often require proof of address to avoid sanctions for trading in unregistered securities.

Organizations might also need proof of address for a variety of reasons, such as to provide service online or ensure postal communication. Additionally, they might need to limit the types of products and services that they offer based on where their clients live.

When implementing POA, organizations need to understand their legal and regulatory requirements, as well as risk strategy and operational considerations. Then they can determine what technologies are appropriate to meet those requirements, while delivering the customer experience they want and ensuring that their compliance and fraud prevention processes are effective.

Proof of Identity

Verification is an important part of the account opening process in Pocket Option, as it ensures your personal and financial information is safe. The process is mandatory under the terms of Know Your Customer (KYC) and Anti-Money Laundering (AML) policies to protect your account and funds from unauthorized use.

When you create a new trading profile in Pocket Option, the first thing you need to do is upload a proof of identity that matches your account details. This can be any identification document such as an international passport, driver’s license, or government-issued ID card. You’ll also need to submit a photo of your identification document. You can do this using a scanner or by taking a photo with your phone camera.

Getting your account verified is easy in Pocket Option and it takes around two to three days to complete the process. Once you’ve successfully submitted your verification documents, you can start trading on your Pocket Option account.

As a regulated broker, Pocket Option has to meet strict KYC and AML regulations in order to comply with the law and prevent fraud. This requires them to verify your identity and address as well as confirm that you have a valid email address.

In addition, the company requires you to upload a proof of address that shows your name and address on paper-issued documents such as utility bills or bank statements. These documents should not be cropped or too small, and all essential information must be clearly visible.

After you’ve successfully uploaded your ID and address proof, you can go ahead with the next step of account verification. This is where you’ll need to submit a document that proves your bank card details. This stage is done to ensure that your withdrawals are processed to the correct bank account. In order to do this, you’ll need to take a picture of the front and back of your card. The image should have good quality, be free from smudges, and be large enough to be read by the software.

How long does Pocket Option verification take?

The duration of this operation can vary, ranging from 1 hour to 1-3 business days in very rare cases. It primarily depends on the accuracy of filling out the required fields and providing documents of good quality. The new verification system operates much faster than before.