Introduction to Cryptocurrency Trading for Beginners

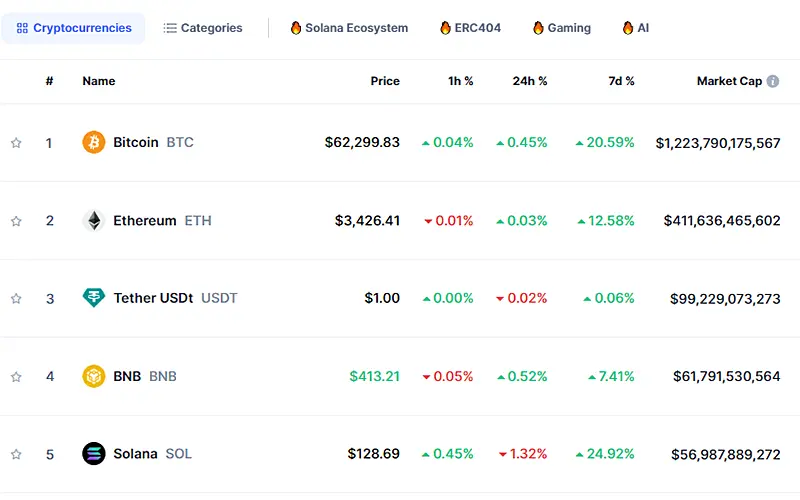

A cryptocurrency is a digital or virtual asset designed to work as a medium of exchange. It uses cryptography to secure and verify transactions as well as to control the creation of new units. Bitcoin, launched in 2009, was the first decentralized cryptocurrency. Since then, as of 2024, over 17,000 cryptocurrencies have been created.

Trading cryptocurrencies simply means buying and selling cryptos with the aim of making profits. Traders analyze factors like price fluctuations and market news to speculate on future price movements of coins. By buying crypto when the prices are low and selling when the prices are high, traders can make substantial profits. They can also trade using derivatives like CFDs and options to profit off both rising and falling prices.

There are several features that make cryptocurrency trading appear promising to many people.

Why Cryptocurrency Trading Appeals to Many

High Volatility

The prices of cryptos are extremely volatile, with moves of 5-10% in a single day being common. This presents lucrative opportunities for traders.

24/7 Accessible Markets

Cryptocurrency markets operate round-the-clock, seven days a week across the globe. This allows more trading opportunities.

Low Barriers to Entry

Opening a basic crypto trading account requires much less capital, paperwork, and approval time compared to opening a stock trading account.

In addition there is another reason why trading bitcoin or other cryptocurrency is becoming more and more popular.

How to Start Crypto Trading: A Step-by-Step Guide

Here are the basic steps to start crypto trading:

- Open a Crypto Trading Account: Sign up with a reliable cryptocurrency exchange or online brokerage platform that supports your region and has robust security in place. You’ll need to complete KYC verification too.

- Deposit Funds: Transfer funds from your bank account to your trading account. Options like wire transfers and debit cards are commonly available.

- Select Cryptocurrencies: Research and select promising cryptocurrencies to trade based on factors like technology, use cases, community strength and market trends. Bitcoin and Ethereum are relatively safe picks for beginners.

- Execute Trades: Use your preferred trading strategy and carefully placed orders like limit orders and stop-loss orders to enter and exit trading positions to profit off crypto price movements.

- Manage Risks: Moderate position sizes, don’t overtrade, set stop losses, secure funds using hardware wallets, and hack-proof accounts to manage risks effectively.

Choosing the Right Cryptocurrency Exchange

With over 500 exchanges globally, new traders may find picking the right platform confusing. Ideal exchanges for beginners should have these key features:

- Easy user interface and mobile apps for convenient trading;

- Broad range of tradable cryptocurrencies;

- Availability of educational resources for novice traders;

- Secure storage of digital assets;

- Strong customer support system;

- Reasonable trading fees and charges;

- Seamless integration with external tools and crypto wallets;

Some of the top exchanges based on these parameters are Coinbase, Bybit, Binance and etc. You can also pay attention to the trading platforms of brokers offering cfd and binary options for cryptocurrency trading. This option is suitable for those who prefer fast speculative trading.

How to Learn Cryptocurrency Trading

Essential Resources for Beginners

Since crypto trading is quite technical, sufficient learning is vital before putting real money at stake. Some key resources to get educated are:

- Online Courses: Structured courses offered by trading experts help build strong fundamental knowledge regarding blockchain technology, technical analysis, and risk management.

- Trading Communities: Participating in forums and social groups creates opportunities to learn from experienced members through ongoing discussions and peer feedback.

- Educational Articles: Well-researched educational articles and explainers from reputable publications offer actionable insights into various strategic aspects of crypto trading.

- Demo Trading Accounts: Paper trading using virtual funds allows beginners to get a feel for real cryptocurrency markets and test strategies without any risks.

Online Courses and Communities

A combination of structured remote learning and community access helps provide well-rounded crypto trading literacy for newbies quicker. Some popular options are:

- Udemy Courses: For around $100, Udemy offers extensive crypto trading video courses for various competency levels created by seasoned market experts and traders.

- Cryptocurrency Certification Consortium: This global community of over 50,000 members actively discusses crypto trading practices through forums, webinars, and networking events, making it a lively option.

Developing Your Trading Strategy

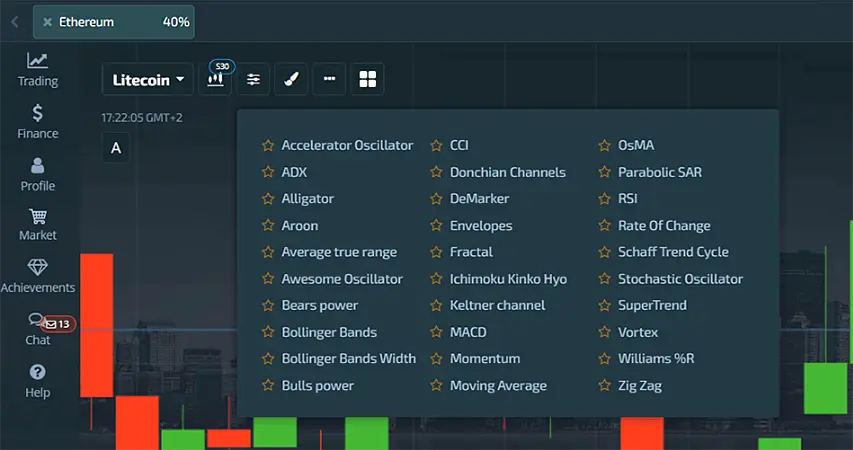

Technical Analysis for Beginners

Technical analysis helps forecast price movements by analyzing historical price charts and market statistics like volume and volatility. Some key concepts are:

- Support and Resistance: Price levels where buying or selling activity typically intensifies, providing possible market entry or exit points.

- Trend Lines: Lines connecting previous peak or trough prices to analyze overall market momentum and direction. Ascending trendlines suggest bullish sentiment while descending trendlines indicate bearish sentiment.

- Moving Averages: Lines reflecting the average closing price over a set period. Crossovers of short and long-term moving averages signal changes in price momentum.

- Chart Patterns: Formations like head and shoulders, triangles and flags that may indicate potential trend continuations or reversals on price charts.

Fundamental Analysis: What You Need to Know

While technical analysis relies purely on charts and data, fundamental analysis studies external factors affecting crypto prices like technology, teams and events. Some key aspects are:

- Examining the Whitepaper: Assessing the underlying protocol, token distribution schedules, roadmaps and other details outlined in a cryptocurrency’s whitepaper allows analysis of its technological viability and commitment to development.

- Team Pedigree: The qualifications and track record of a crypto project’s core team offer insight into its capability to successfully develop cutting-edge solutions and drive adoption.

- Following News and Events: Staying updated on partnerships, protocol upgrades like hard forks, integrations, regulatory rulings and other events provide data to gauge real-world traction.

Risk Management in Cryptocurrency Trading

Setting Up Stop Loss and Take Profit Points

Stop loss and take profit orders help curtail risks from volatility. A stop loss automatically exits positions minimizing losses if the price drops below set levels. Take profits lock in gains by closing trades when prices rise to predetermined levels. Appropriate levels should suit personal risk appetite.

The Importance of Diversification

Since cryptocurrencies tend to be highly volatile, distributing trades across various uncorrelated coins rather than investing solely in Bitcoin, for example, helps nullify risks arising from the underperformance of any specific coin. However, adequate research is necessary before diversifying to avoid buying into hype-driven assets lacking fundamentals.

Practical Tips for Trading Cryptocurrency for Beginners

How to Start Trading Cryptocurrency: Practical Steps

Follow these simple yet effective practical steps for commencing crypto trades as a novice:

- Start small with an amount you can afford to lose entirely without impacting your finances rather than investing your life savings straightaway. $500 is an adequate sum.

- Spend time studying the asset, tracing previous price patterns across intervals ranging from minutes to months before purchasing to determine ideal entry points.

- Don’t let emotions influence trading decisions since the market’s volatility makes it easy to panic sell or greedily overhold when prices fluctuate wildly within short durations.

- Patiently build positions aiming for long-term gains from fundamentally strong assets rather than betting on unreliable speculative assets hoping to become rich quick.

- Keep detailed records of activity for efficiently tracking gains, losses, identifying errors, improving strategy and simplifying tax reporting. Excel sheets are ideal for logging data.

Common Mistakes to Avoid in Crypto Trading

Beginners frequently make these mistakes, resulting in unnecessary losses:

- Investing Blindly in Hyped Tokens: Buying into rising tokens driven purely by celebrity endorsements or social media hype without analyzing project viability leads to losing money when their prices inevitably crash.

- Overleveraging: Using excessively risky margin levels when trading derivatives results in painful liquidations cutting deep into capital when prices drop slightly.

- Weak Account Security: Using simple passwords, not enabling two-factor authentication and lack of other precautions makes accounts susceptible to hackers stealing funds.

- No Stop Losses: Failing to place protective stop losses when opening positions could lead to avoiding serious losses in the event of sharp price declines.

- Overtrading: Excessively trading not only racks up fees substantially but also usually underperforms simple buy-and-hold strategies.

Advanced Trading Concepts

Leveraging and Margin Trading: A Double-Edged Sword

Margin trading features the use of borrowed funds from brokers to open amplified positions increasing profit potential and risk. Conservative margins around 5x prevent unexpected liquidation calls due to minor price drops. Highly risky 100x margins frequently wipe out entire accounts from even slight market reversals.

Understanding and Using Crypto Trading Bots

Trading bots are automated algorithmic software that enters and exits trades 24/7 according to predefined strategies. They eliminate emotional bias and tiredness from manual trading. Bots help implement techniques like order placement based on technical indicators too fast for manual intervention. However, their benefits don’t eliminate the need to continually fine-tune their configuration.

Staying Informed: How to Keep Up with Cryptocurrency Market Trends

Tools and Platforms for Market Analysis

Websites like CoinMarketCap, CoinGecko and TradingView provide extensive historic price data, volatility metrics, trading volumes, analysis tools like candlestick charts and comparison capabilities for traders to harness market analytics to their benefit.

The Role of News in Cryptocurrency Trading

Staying updated on ecosystem news and events through Cointelegraph, CoinDesk, Cryptoslate and r/CryptoCurrency is equally critical for capitalizing on the market impacts of factors like technological upgrades, integrations, regulatory changes and influencer commentary to gain trading advantages early.

Legal and Regulatory Considerations

The regulatory environment for cryptocurrencies keeps evolving rapidly across jurisdictions. Identifying country-specific taxes like short or long term capital gains tax, adhering to reporting requirements, confirming legal standing of assets through Coinbase’s Cryptomap or ICBA guidelines in India and restricting usage based on factors like China’s ban are essential for smooth compliance.

Recap of Key Points for Beginners

Invest sufficient time to learn the ropes thoroughly, be strategic rather than impulsive, manage risks smartly, keep boosting knowledge and stay in tune with ecosystem developments to optimize your cryptocurrency trading success.

- Gain expertise through online courses and communities before actively trading

- Build long-term positions in fundamentally strong digital assets rather than speculation

- Manage risks through prudent position sizing, diversity and stop losses

- Keep learning about technical and fundamental analysis to refine trading

- Stay informed on market trends, news, and regulations